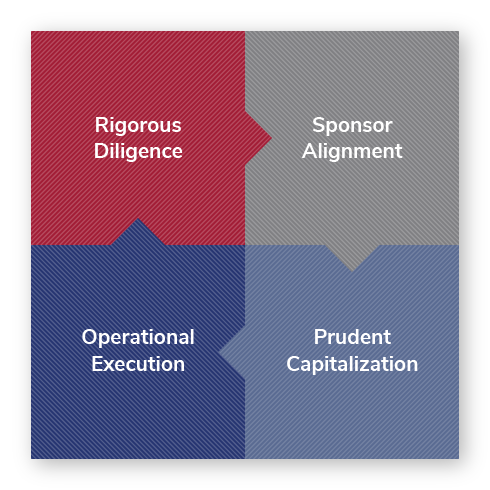

Our Approach

Our proven approach to real estate investing results in speed, low credit risk, and sustainable, outsized returns. Below is a summary of our investment process and the main criteria we target in our investments.

Rigorous Diligence

- Durability: Leveraging 40 years of lodging and economic data, we stress-test the durability of our investments under economic shocks and structural dislocation.

- Growth: We target markets with underlying fundamentals we believe will generate consistent and pronounced demand growth over the next 5 to 15 years.

- Optionality: Our targets must provide optionality for either value-add capital improvement or profitable conversion to an alternative use.

Sponsor Alignment

- Gemini was founded solely with internal capital and only proceeds with investments that we would be willing to fund entirely with our own capital.

- Gemini’s commitment to our investment thesis is demonstrated by its repeated, majority equity stake in approved projects.

Prudent Capitalization

- Applying a Sharpe ratio framework, we will only increase leverage if we believe the return premium over an appropriate risk-free benchmark will increase more, on a relative basis, than volatility.

- All assets are funded with long-term debt to match our targeted hold period. We stress-test debt service coverage metrics on all acquisitions.

- Our debt is balanced with well-laddered maturities. We refinance our loans at least two years prior to maturity to mitigate solvency risk in the event of an extended market contraction.

Operational Execution

- Gemini’s leadership has over three decades of diverse operational experience that has consistently delivered market leading results.

- When appropriate, Gemini will engage top-tier external management companies that have geographic expertise or operational economies of scale.

- Gemini manages every aspect of capital projects, including entitlement, design, permitting, and construction. Our line of sight always focuses on clear and measurable goals.